All Categories

Featured

Table of Contents

I imply, those are the various kinds. So it's hard to contrast one Fixed Annuity, an instant annuity, to a variable annuity because a prompt annuity's are for a life time earnings. A variable annuity could be for growth or should be for development, intended development, or limited development, okay? Very same point to the Deferred Earnings Annuity and Qualified Longevity Annuity Agreement.

Those are pension plan products. Those are transfer danger products that will certainly pay you or pay you and a spouse for as lengthy as you are taking a breath. Yet I think that the much better correlation for me to compare is looking at the set index annuity and the Multi-Year Assurance Annuity, which by the way, are provided at the state degree.

Currently, the issue we're facing in the market is that the indexed annuity sales pitch seems eerily like the variable annuity sales pitch however with principal security. And you're available going, "Wait, that's precisely what I want, Stan The Annuity Guy. That's exactly the product I was looking for.

Index annuities are CD items issued at the state degree. Okay? Period. End of tale. They were put on the world in 1995 to compete with typical CD rates. And in this globe, typical MYGA fixed prices. That's the sort of 2 to 4% world you're looking at. And there are a great deal of individuals that call me, and I obtained a telephone call a few days ago, this is a terrific example.

The person stated I was going to get 6 to 9% returns. And I'm like, "Well, the great information is you're never going to shed cash.

Exploring the Basics of Retirement Options A Comprehensive Guide to Investment Choices Defining Retirement Income Fixed Vs Variable Annuity Features of Fixed Annuity Or Variable Annuity Why Retirement Income Fixed Vs Variable Annuity Can Impact Your Future How to Compare Different Investment Plans: How It Works Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Risks of Indexed Annuity Vs Fixed Annuity Who Should Consider Immediate Fixed Annuity Vs Variable Annuity? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Deferred Annuity Vs Variable Annuity A Closer Look at Fixed Index Annuity Vs Variable Annuities

Allow's simply state that. And so I resembled, "There's not much you can do because it was a 10-year item on the index annuity, which implies there are surrender costs."And I always tell individuals with index annuities that have the one-year call option, and you acquire a 10-year abandonment fee item, you're acquiring an one-year guarantee with a 10-year surrender charge.

Index annuities versus variable. One's a CD-type item, one's development, although the index annuity is mis-sold as type of a variable, no. The annuity sector's variation of a CD is currently a Multi-Year Warranty Annuity, compared to a variable annuity. This is no contrast. You're getting an MYGA, a major security product that pays a certain rates of interest for a specific duration.

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Features of Smart Investment Choices Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing Pros And Cons Of Fixed Annuity And Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Retirement Income Fixed Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

It's not a MYGA, so you can not contrast the two. It truly boils down to the 2 questions I always ask people, what do you want the cash to do contractually? And when do you desire those legal guarantees to start? That's where repaired annuities are available in. We're speaking about agreements.

With any luck, that will change due to the fact that the industry will certainly make some modifications. I see some ingenious products coming for the signed up financial investment advisor in the variable annuity world, and I'm going to wait and see exactly how that all trembles out. Never neglect to live in truth, not the dream, with annuities and contractual guarantees!

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works What Is Fixed Interest Annuity Vs Variable Investment Annuity? Pros and Cons of Fixed Income Annuity Vs Variable Growth Annuity Why Choosing the Right Financial Strategy Is Worth Considering Tax Benefits Of Fixed Vs Variable Annuities: How It Works Key Differences Between Choosing Between Fixed Annuity And Variable Annuity Understanding the Rewards of Fixed Income Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Annuity Vs Equity-linked Variable Annuity A Beginner’s Guide to Fixed Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

Annuities are a kind of investment product that is typically used for retirement preparation. They can be defined as agreements that offer payments to a specific, for either a particular amount of time, or the rest of your life. In basic terms, you will spend either a single repayment, or smaller regular settlements, and in exchange, you will receive settlements based on the amount you invested, plus your returns.

The price of return is evaluated the start of your contract and will certainly not be affected by market variations. A fixed annuity is a terrific alternative for somebody looking for a steady and predictable resource of earnings. Variable Annuities Variable annuities are annuities that permit you to spend your costs into a variety of choices like bonds, supplies, or common funds.

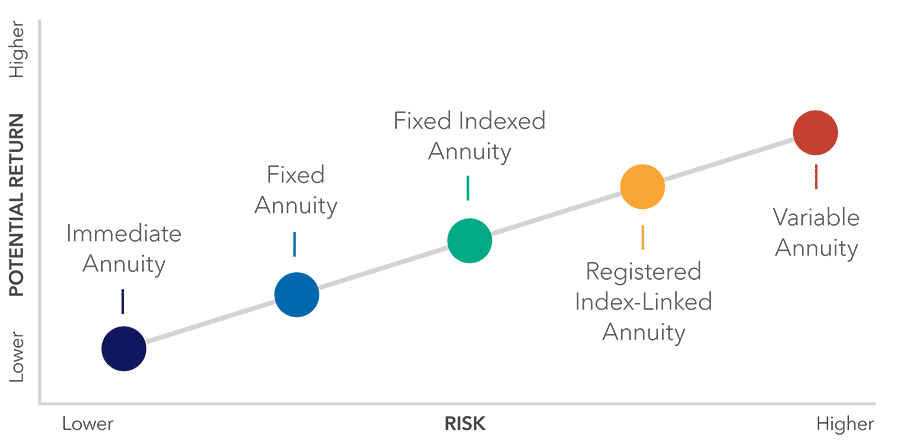

While this implies that variable annuities have the potential to offer greater returns compared to fixed annuities, it likewise means your return price can change. You may be able to make more earnings in this situation, yet you likewise risk of potentially shedding money. Fixed-Indexed Annuities Fixed-indexed annuities, additionally understood as equity-indexed annuities, incorporate both taken care of and variable features.

Decoding What Is A Variable Annuity Vs A Fixed Annuity A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Pros and Cons of Pros And Cons Of Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Immediate Fixed Annuity Vs Variable Annuity Who Should Consider Annuities Variable Vs Fixed? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Index Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity

This gives a fixed level of revenue, in addition to the chance to gain added returns based upon various other financial investments. While this normally safeguards you against shedding income, it additionally restricts the earnings you may be able to make. This type of annuity is an excellent alternative for those searching for some safety and security, and the capacity for high profits.

These financiers buy shares in the fund, and the fund spends the cash, based upon its stated purpose. Common funds include selections in major asset classes such as equities (supplies), fixed-income (bonds) and cash market safety and securities. Financiers share in the gains or losses of the fund, and returns are not guaranteed.

Investors in annuities shift the threat of running out of cash to the insurance business. Annuities are frequently a lot more pricey than common funds since of this function.

Both shared funds and annuity accounts offer you a range of choices for your retirement financial savings needs. However spending for retirement is only one component of preparing for your financial future it's simply as vital to determine how you will get earnings in retired life. Annuities generally use more alternatives when it involves getting this earnings.

You can take lump-sum or systematic withdrawals, or select from the following income alternatives: Single-life annuity: Offers regular benefit settlements for the life of the annuity proprietor. Joint-life annuity: Deals regular advantage repayments for the life of the annuity owner and a companion. Fixed-period annuity: Pays revenue for a defined variety of years.

For aid in developing a financial investment strategy, call TIAA at 800 842-2252, Monday via Friday, 8 a.m.

Investors in capitalists annuities delayed periodic investments routine build up construct large sum, after which the payments beginSettlements Obtain quick responses to your annuity concerns: Call 800-872-6684 (9-5 EST) What is the difference in between a repaired annuity and a variable annuity? Fixed annuities pay the exact same quantity each month, while variable annuities pay a quantity that depends on the financial investment efficiency of the investments held by the certain annuity.

Why would you want an annuity? Tax-Advantaged Investing: When funds are bought an annuity (within a retired life plan, or not) development of resources, returns and passion are all tax deferred. Investments right into annuities can be either tax obligation insurance deductible or non-tax deductible contributions depending upon whether the annuity is within a retirement or not.

Highlighting the Key Features of Long-Term Investments Key Insights on What Is A Variable Annuity Vs A Fixed Annuity Defining the Right Financial Strategy Pros and Cons of Annuities Variable Vs Fixed Why Choosing the Right Financial Strategy Can Impact Your Future Indexed Annuity Vs Fixed Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Variable Annuity Vs Fixed Annuity Who Should Consider Fixed Interest Annuity Vs Variable Investment Annuity? Tips for Choosing Variable Annuity Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Retirement Income Fixed Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity

Circulations from annuities paid for by tax deductible payments are fully taxed at the recipient's then current earnings tax obligation price. Distributions from annuities spent for by non-tax insurance deductible funds go through special treatment due to the fact that some of the routine repayment is really a return of resources spent and this is not taxable, just the passion or investment gain portion is taxed at the recipient's after that current income tax rate.

(For extra on tax obligations, see IRS Publication 575) I was reluctant at very first to acquire an annuity on the internet. You made the whole point go really basic.

This is the topic of another post.

Table of Contents

Latest Posts

Understanding What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Wh

Breaking Down Retirement Income Fixed Vs Variable Annuity Everything You Need to Know About Fixed Vs Variable Annuity Defining the Right Financial Strategy Features of Immediate Fixed Annuity Vs Varia

Breaking Down Your Investment Choices Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Features of Fixed Vs Variable Annuity Pros Cons Why Choosing the Right Financia

More

Latest Posts